Stick and twist: Navigating food and drink purchasing behaviours during the cost-of-living crisis

The importance of purpose, value and authenticity to attract and retain customer loyalty and protect reputation

As the real impacts of the cost-of-living crisis unfold and the food and drink sector finds itself facing a perfect storm of issues, the FleishmanHillard UK Food, Agriculture and Beverage team is exploring the implications for brand and communication teams in our new ‘Cost-of-Living Bites’ series.

Pauline Gillingham, a director in FleishmanHillard UK’s Corporate team, takes a look at the need to demonstrate meaningful action, greater value and an authentic voice to keep consumers on-side and buying your brands.

Whichever way you come at it, the “cost-of-living crisis” is a phrase that’s slipped into common parlance and isn’t leaving lips, agendas, front pages or screens any time soon.

It’s bleak. For a generation of consumers that are still in a post-pandemic mindset and haven’t been exposed to inflation of this magnitude before, it’s a major blow to confidence – especially as talk of recession escalates.

Spending power is shrinking, and swathes are already adapting purchasing behaviours to manage – shifting to cheaper brands, making fewer shopping trips, prioritising essential spend, and/or opting away from healthier or more sustainable choices out of necessity.

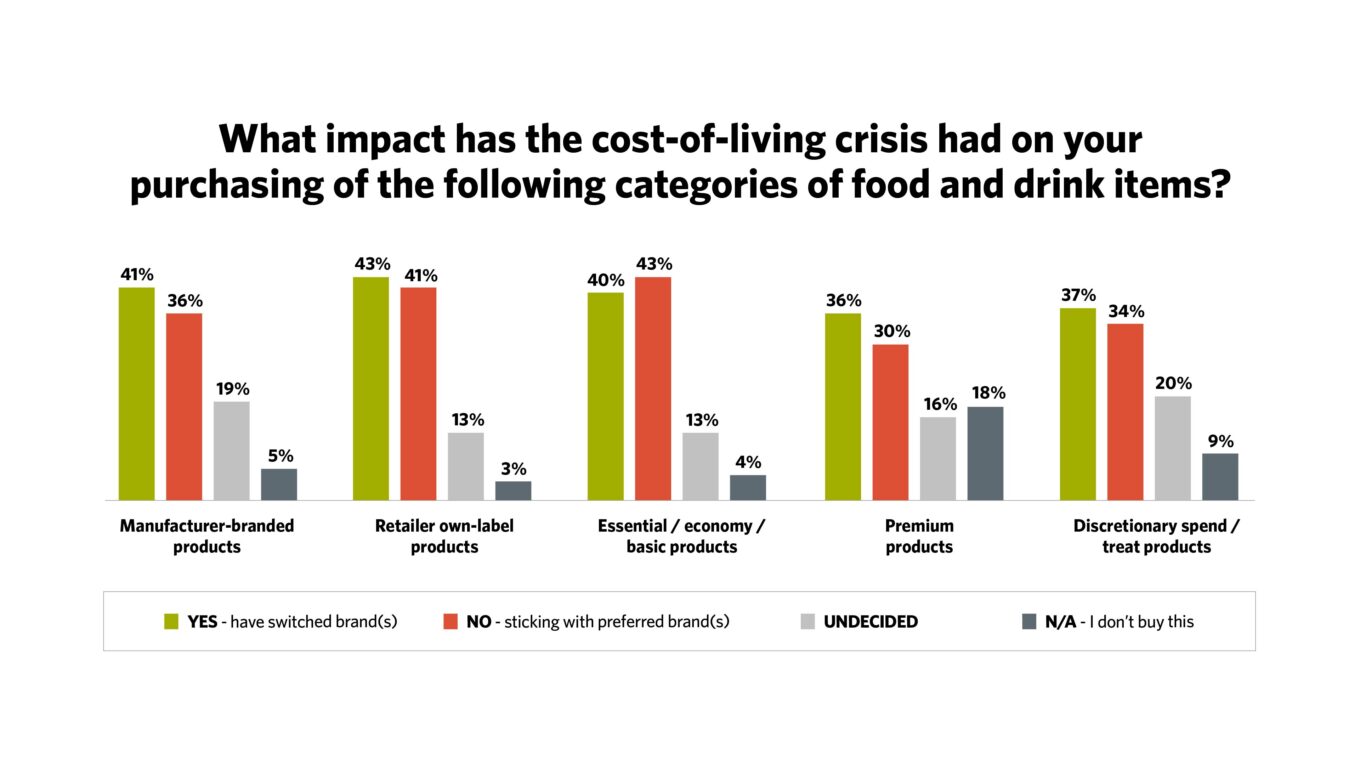

However, as a survey of 2,000 UK consumers commissioned by FleishmanHillard UK in early July 2022 shows, people’s behaviours are fickle in the face of the ongoing uncertainty. The graph below shows, nearly half are prepared to switch to other brands across categories.

Meanwhile, food and drink businesses and retailers are unable to absorb the rising costs of doing business and face added pressures from politicians, regulators and consumers to deliver healthier more sustainable products for less.

Manufacturers and retailers need to work through how best to navigate how this evolving cost-of-living pressure will impact on loyalty and revenues. What steps make most sense for the business, and what’s the role for comms?

-

Meaningful, purpose-led action and support

Our survey found at least six in ten people think food and drink manufacturers (65%) and retailers (60%) are putting their own profits before people’s needs when increasing prices.

So, especially when prices can’t be kept lower, to avoid being seen as opportunistic, the more done to demonstrate the brand is on the side of consumers and contributing to positive societal outcomes throughout the crisis the better.

From offering practical educational support and hacks to help make eating on a budget less onerous to pushing for policies or tangible united industry action to support families, for example, there are more immediate steps brands can take that to benefit reputation in the short and long-term.

Whatever the move, the comms team has a critical role to play in ensuring it’s authentic to the brand’s purpose, values and voice, is considered and not tokenistic or tone deaf in any way – a trap several brands have sadly fallen into already.

-

Building the brand value proposition

As Omnicom colleagues at Hall & Partners will attest, heading towards a recession, many food and drink businesses are reflecting on the 80/20 rule i.e., which 20% of customers will generate circa 80% of revenue – a truism for many brands across sectors.

Loyalty from the right customers becomes key and there’s a powerful play for brands and retailers to retain customers, and attract switching ones, by differentiating beyond price through the development of enhanced brand value propositions.

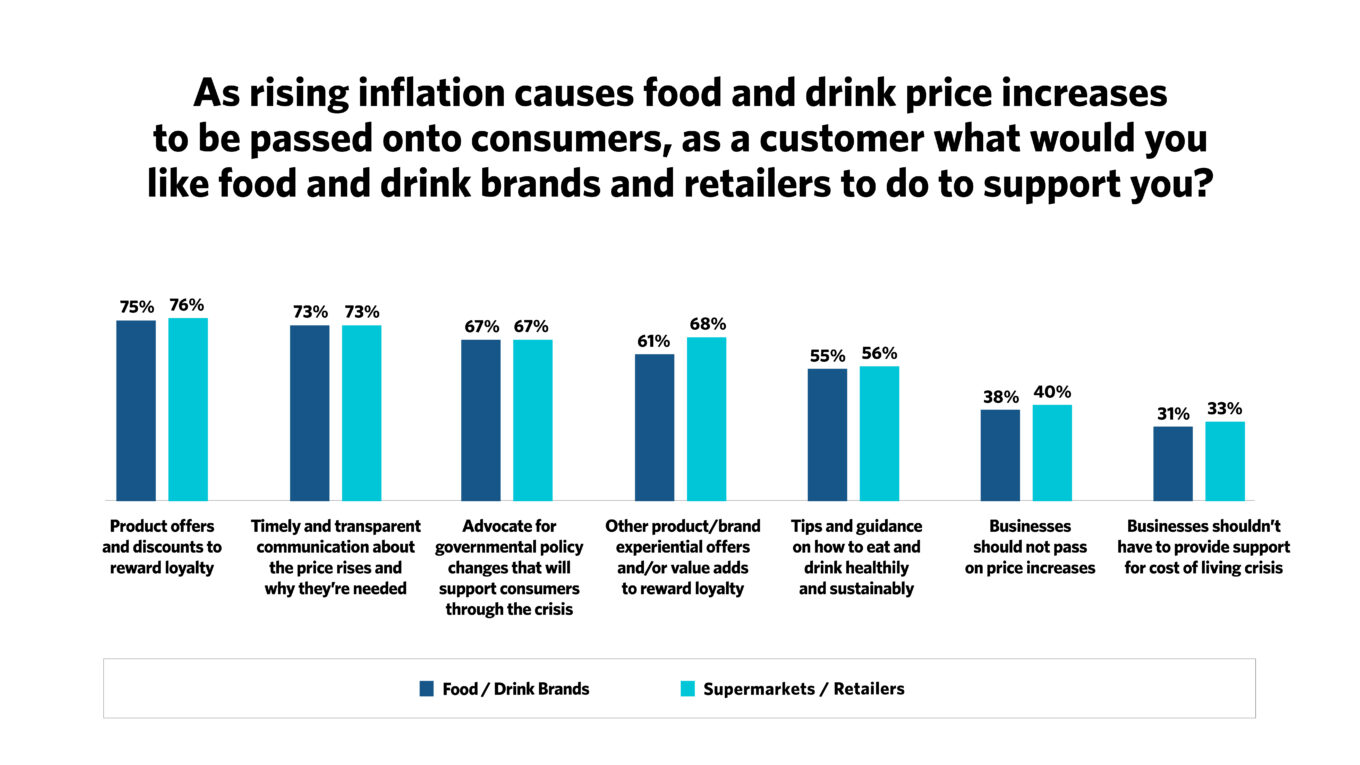

Our survey found that alongside well-worn marketing tactics like coupons and BOGOFs, innovative loyalty programmes and subscription offers may come to the fore, with tailored personalisation becoming increasingly important.

Brands will benefit from leaning into curating and delivering experiences around products that provide either valuable support in the crisis (linking to the meaningful action point) or moments of joy and reward as much-needed escapism.

Once evolved, brand and comms teams need to make sure the brand value proposition adapted for the cost-of-living context is landed in a clear, compelling and consistent way across all channels.

-

Credible, transparent communications

While brands need to demonstrate they’re being responsible and responsive to consumers’ needs, at the most basic level, there’s a need for all communications around price changes to be forthcoming, transparent and empathic in the current climate.

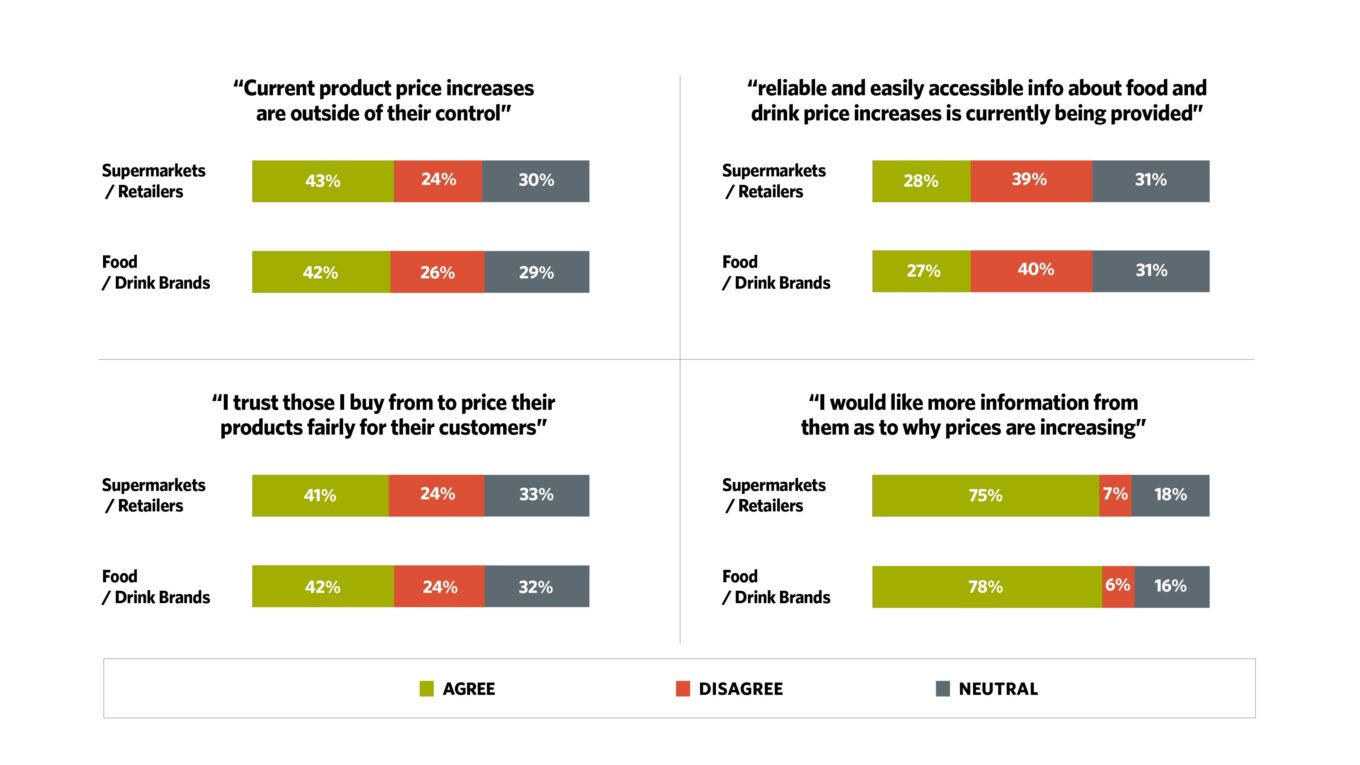

While circa two-fifths of respondents agreed current product price increases are outside of both parties’ control (42% for brands/manufacturers; 43% for supermarkets/retailers) and they trust those they buy from to price products fairly for customers (42% for brands/manufacturers; 41% for supermarkets/retailers), only around a quarter feel reliable and easily accessible information about food and drink price increases is currently being provided (27% for brands/manufacturers; 28% for supermarkets/retailers).

The vast majority stated they would like more information from both as to why prices are increasing (78% for brands/manufacturers; 75% for supermarkets/retailers).

In summary

As businesses navigate through changing purchasing behaviours and work out their optimal route to get customers to stick or twist in their direction, there’s a real opportunity to steer business and communications decisions and action by harnessing data intelligence.

Utilising audience insights and tapping into cultural and media trends related to the cost-of-living crisis will help to build relevance, reach and resonance among core audiences linked to changing consumer attitudes and behaviours as the crisis evolves.

Marrying this with data analysis that demonstrates and optimises the impact of subsequent planned comms activity is also a must to prove return on investment when budgets are tight and calls are being made to divert spend elsewhere.

Research carried out by TRUE Global Intelligence in partnership with Vitreous World.

Online survey fielded to 2,000 UK adults with nationally representative samples for age, gender, region, SEG, ethnicity, sexual orientation and disability. Fieldwork ran from 7th – 10th July 2022.

Find Out More

-

Platinum CMS Award

March 13, 2024

-

Changing Communications Tack at Mobile World Congress

February 21, 2024